What is NISM? What is the full form of NISM? Let’s get these basic questions out of the way. NISM full form- National Institute of Securities Markets. It plays a pivotal role in enhancing the standards of the securities market in India. Established by the Securities and Exchange Board of India (SEBI) in 2006, NISM is dedicated to nurturing proficient professionals in the securities markets through its education, training, and certification programs. This blog aims to provide a detailed insight into NISM, its objectives, certifications, and the impact it has on the Indian securities market.

Objectives of NISM

NISM is primarily focused on the following objectives:

- Education and Awareness: Offering a range of educational programs to create a better understanding of the securities markets

- Certification of Professionals: Conducting examinations and certifications to ensure that market participants have the necessary knowledge and skills

- Research and Development: Engaging in research to contribute to the development of the securities markets

- Setting Standards: Establishing benchmarks for professionals to ensure compliance with the best industry practices

NISM Certification Programs

The National Institute of Securities Markets offers a wide range of certification exams that cater to various aspects of the securities markets. These certifications are essential for individuals seeking to pursue a career in finance and securities. Some of the popular NISM certification exams include:

- Series I: Currency Derivatives Certification Examination

- Series VII: Securities Operations and Risk Management

- Series VIII: Equity Derivatives Certification Examination

- Mutual Fund Distributors Certification Examination

These certifications are designed to test the candidates’ understanding of the market, regulations, and operational aspects.

Eligibility and Examination

The eligibility criteria for NISM certification exams are quite flexible, primarily requiring the candidate to have passed the 10+2 examination or equivalent. The exams are conducted online and consist of multiple-choice questions, testing the practical knowledge and understanding of the Indian securities market.

Importance of NISM Certifications

- Career Advancement: For finance professionals, these certifications open doors to advanced career opportunities in the securities market

- Regulatory Compliance: Certain certifications are mandatory for individuals engaged in specific roles in the securities markets

- Knowledge Enhancement: These programs provide in-depth knowledge of market operations, regulations, and ethics

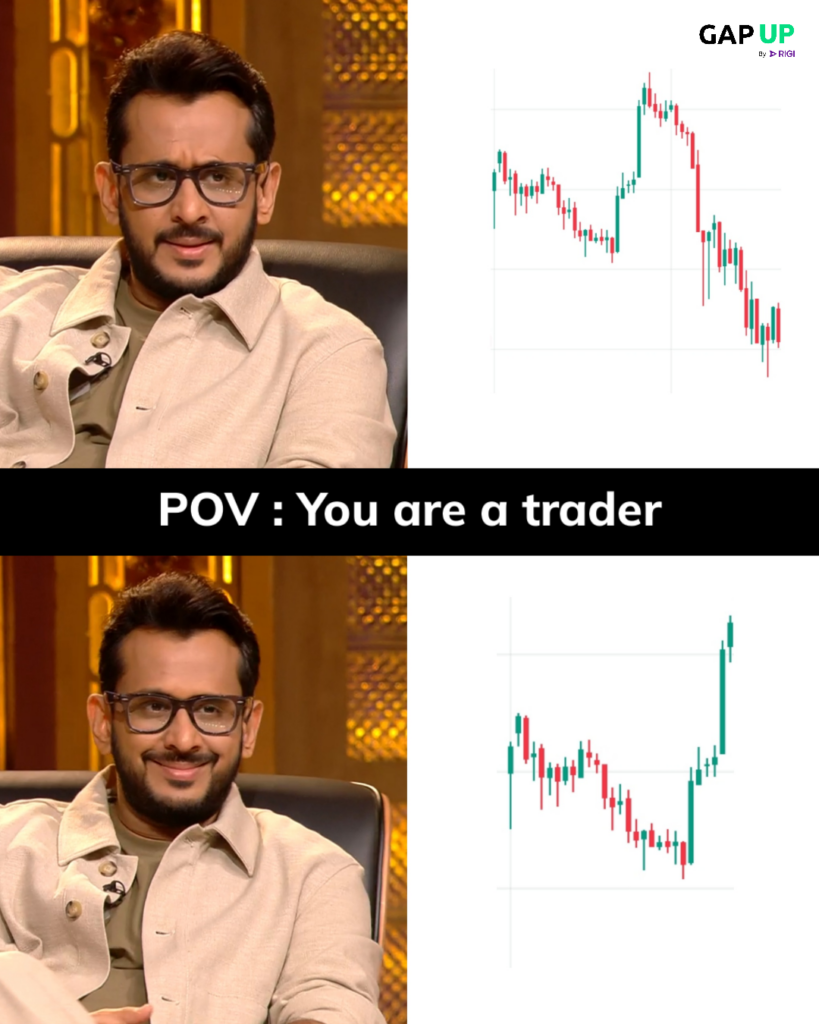

It goes without saying that the stock market is unpredictable and the need to have a regulatory body cannot be overstated.

Impact on the Securities Market

NISM plays a significant role in enhancing the integrity and efficiency of the Indian securities market:

- Standardizing Practices: By setting benchmarks for knowledge and skills, NISM ensures a high standard of professionalism in the industry

- Investor Protection: Educated professionals lead to better advice and services for investors, ultimately protecting their interests

- Market Development: Continuous research and education contribute to the overall development and sophistication of the market

It is important to rely on trading calls and insights from SEBI-registered experts so as to avoid pitfalls. Do not fall for quick money schemes and other promises. Always ensure that you are trading smart through registered and verified channels.

Suggested Read: SEBI Registered Telegram Channels in India

Conclusion

NISM serves as a cornerstone in the Indian securities markets, fostering growth and ensuring the upskilling of professionals. Whether you are a student aspiring to enter the world of finance, a professional seeking to elevate your career, or a stakeholder in the securities market, understanding the role and offerings of NISM is invaluable. With its comprehensive certification programs and commitment to market development, it continues to be an integral part of India’s financial ecosystem.