Trading can be as challenging as it is rewarding, presenting both seasoned traders and beginners with endless opportunities for success. However, it goes without saying that navigating the financial markets requires more than just luck; it calls for strategic planning and smart decision-making. More often than not, traders are on the look out for trading tricks that work the best, trading tricks that minimize loss, trading tricks to help traders and the like. Let’s explore some of the most effective trading tricks that can help traders of all levels improve their performance.

Top 5 Trading Tricks

Before we take a look at top trading tricks, it is important to understand that you have to trade with caution and precision. This is not a “get rich quick” scheme. Do not fall for unreliable advice and calls.

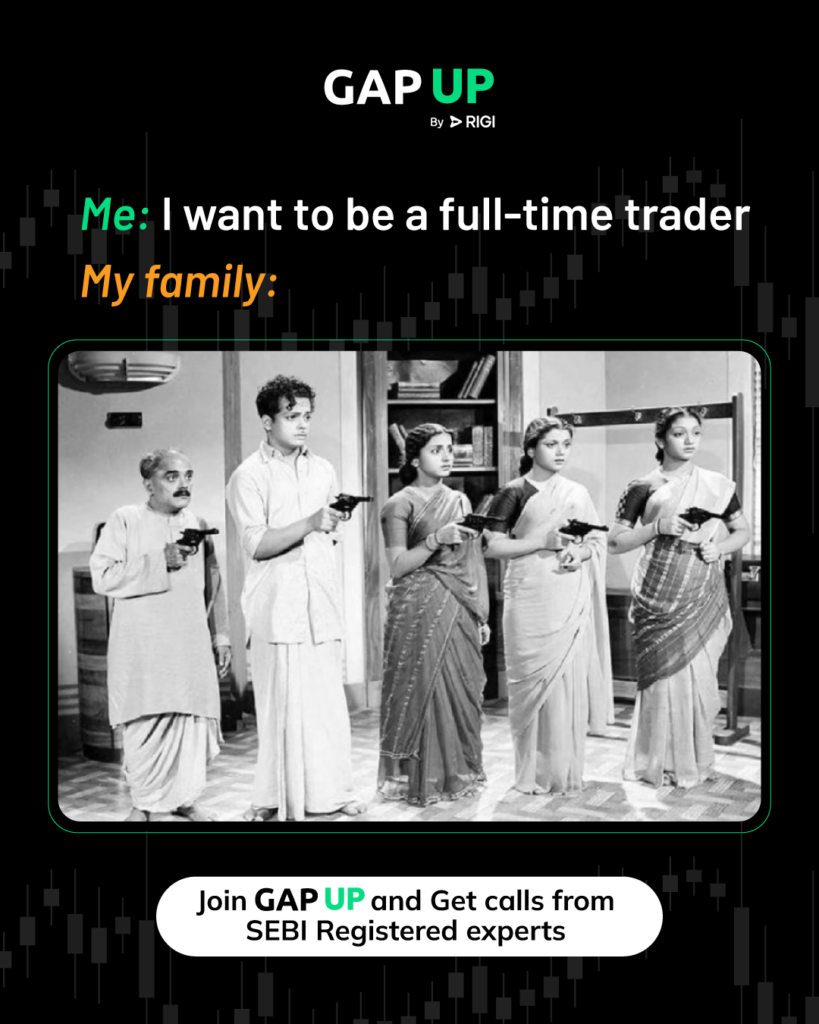

To ensure that your family does not react the above way, follow these tips:

Understanding Market Trends

A deep understanding of market trends is crucial for any successful trading strategy. This section would delve into how traders can analyze market indicators like moving averages and volume trends, and stay updated with global economic events that could impact the markets.

Join telegram groups and channels where regular live sessions are conducted and that are conducted by trustworthy SEBI registered experts to ensure that you stay on top of the trends and to avoid pitfalls.

Risk Management Techniques

Essential to trading is the ability to manage risk effectively. It is important to set up risk-reward ratios, stop-loss orders, and diversify portfolios to mitigate risks and improve chances of steady returns.

Trading Psychology

Beyond the numbers and charts, trading is profoundly influenced by psychological factors. Emotional discipline and resilience is of paramount importance , and how to avoid common pitfalls like emotional reactions to market changes or the temptation to overtrade.

The Role of Technical Analysis

Technical analysis is a key element in any trader’s toolkit.Chart patterns and technical indicators, such as the Relative Strength Index (RSI) and Fibonacci retracement, might sound confusing for beginners. It is important to make yourself familiar with the important terms in trading.

The Importance of Ongoing Learning

The financial markets are constantly evolving, and so should trading strategies. This part would encourage continuous learning through courses, webinars, and insights from trading experts, stressing the importance of staying adaptable and continuously refining trading approaches.

Success in trading is not just about making the right moves; it’s about being informed, disciplined, and adaptable. The trading tricks discussed in this blog can significantly enhance your ability to navigate the financial markets with more confidence and skill. With patience and continuous learning, anyone can improve their trading acumen.

Interested in further honing your trading skills? Join Gap Up and get trading calls from top SEBI registered experts in the country.

FAQs about Trading Tricks

How Important is Diversification in Indian Markets?

Diversification is crucial as it helps in reducing the risk by spreading investments across various sectors and asset classes. In volatile markets like India, this is especially important to mitigate sector-specific and market-wide risks.

Can Beginners Apply Technical Analysis Successfully?

Yes, beginners can learn and apply technical analysis successfully. However, it requires time and effort to understand technical charts, trends, and patterns. Beginners should start with basic concepts and gradually explore more advanced techniques. It is advisable to follow SEBI registered experts to understand the same.

What is SEBI?

The Securities and Exchange Board of India (SEBI) is the regulatory body for the securities and commodity market in India under the jurisdiction of the Ministry of Finance, Government of India. It was established on April 12, 1988, and given statutory powers on January 30, 1992, through the SEBI Act, 1992. Learn more here.