What is the Santa Claus Rally?

It is that time of the year again. Christmas lights and cookie doughs everywhere and the rally of positive vibes. Along with it comes the Santa Claus Rally! What exactly is the Santa Claus Rally? The Santa Claus Rally refers to a phenomenon in the stock market where there’s an uptick in stock prices in the final weeks of December and the first few trading days of the new year. This trend is not guaranteed, but historically, it’s been observed often enough to gain a noteworthy place in the market lore.

History of Santa Claus Rally

Let us understand where the term Santa Claus Rally came from. It was first coined in the 1970s, but the pattern it describes has been noted by stock market analysts for decades. It typically occurs during the last five trading days of the year and the first two of the new year. Statistically, the market has shown a tendency to rise during this period more frequently than it falls.

Reasons Behind the Santa Claus Rally

Several theories attempt to explain why the Santa Claus Rally happens:

- Holiday Optimism: The festive mood and general optimism around the holiday season may encourage more buying than selling.

- Tax Considerations: Investors might be adjusting their portfolios for tax purposes before the year ends.

- Institutional Investor Activity: Many large investors go on holiday, leading to lower market volume, which can sometimes result in higher stock prices.

- Year-End Bonuses: Some investors use year-end bonuses to purchase stocks, potentially driving prices up.

- Window Dressing: This is when fund managers, looking to improve their year-end numbers, buy stocks that have performed well during the year.

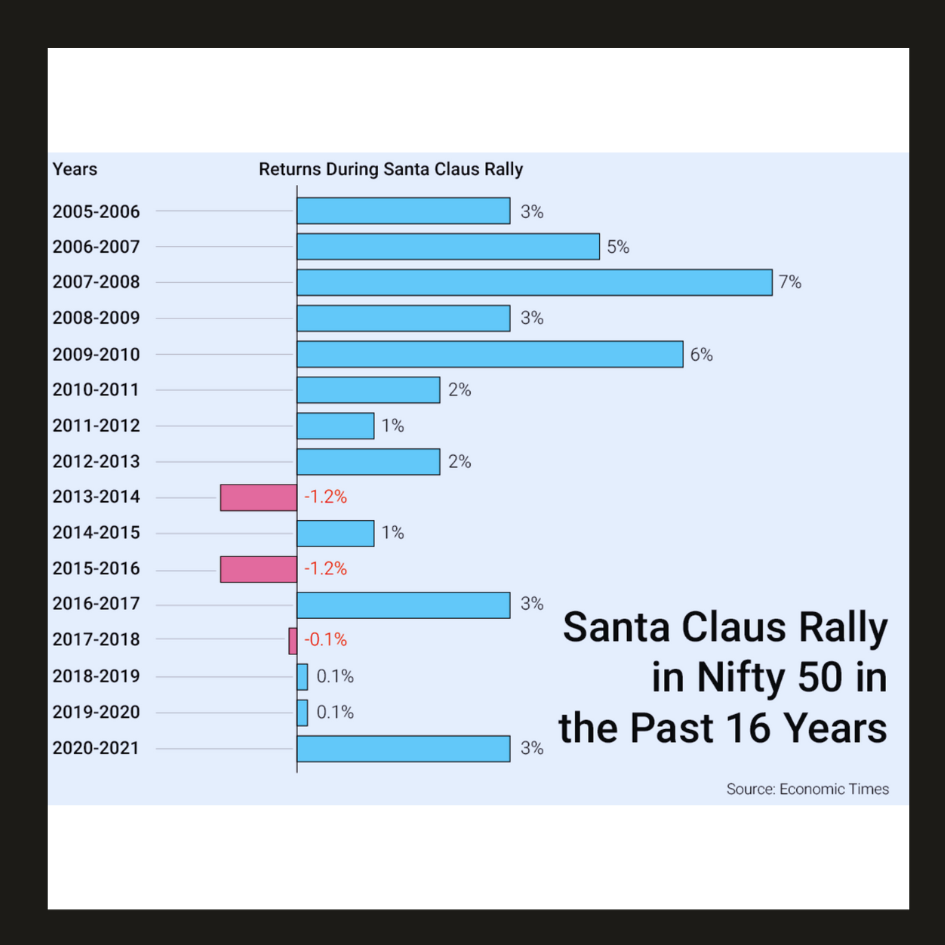

Does the Santa Claus rally occur in the Indian markets?

While the Santa Claus rally is a global phenomenon, it has been relatively lesser known in India. However, in recent years, the Indian stock market has begun to exhibit a modest upward movement in the final week of December, aligning with this trend. Let us take a look at the trend:

Ensure that you make smart decisions while trading, check out Gap Up for trading insights from authentic, SEBI registered experts.

What is the January Barometer?

The January Barometer refers to the notion that stock market performance in January can be a predictor of its trend for the rest of the year. This theory posits that if the stock market experiences gains in January, it is likely to continue performing positively throughout the year, whereas a decline in January could signal a year-long downward trend.

Impact on Investors

The Santa Claus Rally can be a boon for both short-term and long-term investors. For short-term traders, it presents an opportunity to capitalize on the potential uptick in prices. Long-term investors might see it as a favorable time to review and adjust their portfolios.

Suggested Read: Who is A SEBI Registered Investment Advisor

A Word of Caution

While the rally is an interesting market phenomenon, it’s important for investors not to base their investment strategies solely on seasonal trends. The stock market is influenced by a myriad of factors, and seasonal patterns, while intriguing, should not override sound investment principles and risk management strategies.

Ensure that you make smart decisions while trading, check out Gap Up for trading insights from authentic, SEBI registered experts.

Conclusion

The Santa Claus Rally is a fascinating aspect of stock market behavior, embodying a blend of historical trends, psychological factors, and market dynamics. Whether you’re a seasoned investor or a newcomer to the markets, understanding this phenomenon can add another dimension to your investment strategy. However, it’s crucial to remember that like all market trends, the Santa Claus Rally is not a sure thing, and wise investing should always be grounded in research and a solid understanding of market fundamentals.

FAQs About the Santa Claus Rally

Q1: Is the Santa Claus Rally a reliable occurrence every year?

A: The Santa Claus Rally is a historical trend, not a guarantee. While it has been observed frequently, there are years when the market does not experience this uptick.

Q2: Can the Santa Claus Rally impact all types of stocks?

A: The rally can affect various sectors, but its impact may not be uniform across all types of stocks. Typically, larger, more established companies might show more noticeable changes.

Q3: Should I adjust my long-term investment strategy based on the Santa Claus Rally?

A: It’s generally not advisable to make significant changes to a long-term investment strategy based on short-term trends like the Santa Claus Rally. Always consider your overall investment goals and risk tolerance.

Q4: How long does the Santa Claus Rally typically last?

A: The rally is usually observed during the last five trading days of December and the first two trading days of January.

Q5: What causes the Rally?

A: There are several theories, including holiday optimism, tax considerations, changes in institutional investor activity, and year-end bonuses.

Q6: Is the Santa Claus Rally just a U.S. market phenomenon?

A: While most commonly observed in the U.S. stock market, variations of the Rally have been noted in other global markets as well.

Q7: Can new investors take advantage of the Rally?

A: New investors can observe the rally as part of their learning process. However, it’s important for them to make investment decisions based on comprehensive research and not just on seasonal trends.

Q8: Does the Rally have any long-term impact on the market?

A: The Santa Claus Rally is primarily a short-term trend and does not typically have a significant long-term impact on the market.